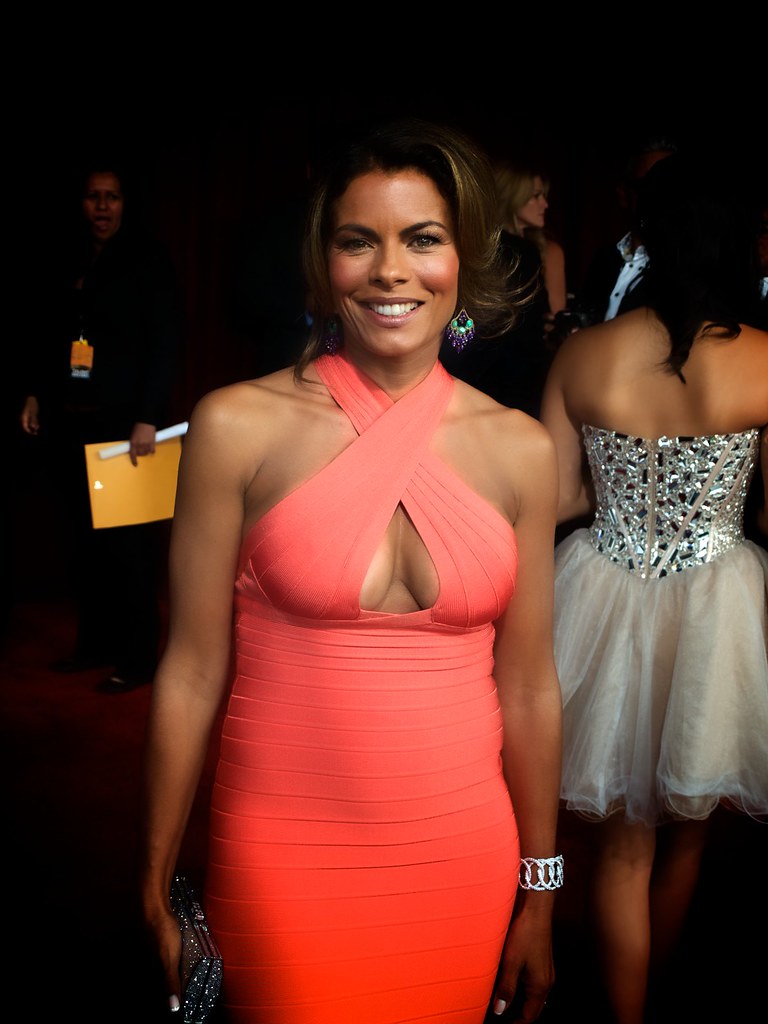

One year after Lisa Vidal son’s tragic death, she filed lawsuit against former manager

Lisa Vidal Files $2M Lawsuit Against Ex-Business Manager

Lisa Vidal former business manager allegedly issued incorrect checks

In a recent article published by Meow.com, Jay Cohen, an American real estate agent, is well-known for being the beloved husband of Hollywood actress Lisa Vidal.

Jay and Lisa Vidal got married on January 6, 1990, and maintained a strong relationship for 33 years. Despite being married to the star of The Division, Jay has maintained a very private life, keeping details such as his childhood, parents, siblings, and education away from the public eye.

According to Lisa Vidal, she engaged in an agreement with DLD and Duban in 2013, in which they were designated to serve as Lisa Vidal business manager and CPA tax advisor. Under this arrangement, their responsibilities included overseeing Lisa Vidal personal and entertainment company’s financial affairs, handling tax-related matters, and managing bill payments

Read Also:Lisa Vidal files $2M lawsuit against ex-business manager one year after son’s tragic death

Lisa Vidal and her husband alleges their manager for not fulfilling their assigned responsibilities. The $2 million lawsuit states that they frequently issued incorrect checks and made payments to the wrong recipients. Former manager also routinely wrote checks and made payments with inaccurate sums to the wrong entities. As a result, Lisa Vidal was hit with a $15k tax liens by the IRS and California Franchise Tax Board in 2015.

The IRS (Internal Revenue Service) and the FTB (Franchise Tax Board) sent numerous mailings to defendants regarding the tax assessment, none of which were disclosed to Lisa Vidal. Eventually, the IRS created a tax lien in the approximate amount of $400,000.00. Lisa Vidal were unaware of the tax lien.

Moreover, Lisa Vidal found out that the defendants had been making requests for funds from her 401k and transferring them to her checking account. Lisa Vidal is seeking more than $2 million in compensation.

Read Also:Jake Paul likely to ditch 10-fight world title dream after Tommy Fury rematch: ‘I want KSI’

Pingback: State Pension Increase 2023: Prospects and Tax Implications for Pensioners – Port Mouth Press