Shares of IonQ, along with several other quantum computing companies, have taken a significant hit in the market, following a startling prediction from Nvidia CEO Jensen Huang. Huang estimated that it could be as long as 20 years before we see “very useful quantum computers,” which has caused panic among investors. This news comes after a previous period of excitement for the industry, leading to a sharp decline in stock prices for companies like IonQ and Rigetti Computing.

Market Reaction and Stock Decline

On January 10, 2024, IonQ’s stock dropped dramatically by 39%, while Rigetti suffered an even harsher decline, plummeting 45%. This was a tough day for investors, who had been riding high on expectations of rapid advancements in quantum technology. Just a few months earlier, stocks for quantum computing firms were rallying, boosted by technological breakthroughs and rising interest from major tech players.

Nvidia’s Cautious Outlook

Huang’s statements resonated through financial markets, suggesting that quantum computers might not be ready for mainstream application any time soon. His caution highlights that despite exciting research and development, the practical applications of quantum computers are still distant. He made it clear that while quantum computing has massive potential, it cannot solve every problem just yet. This message seemed to clash with the optimism previously held by investors looking at advancements made by companies like IonQ, which had recently demonstrated capabilities using Nvidia’s quantum software.

Implications for Quantum Computing Firms

Despite the drop in stock prices, the future might still hold promise for companies like IonQ. A bipartisan US Senate bill proposed funding of $2.7 billion for quantum computing research, which indicates strong government backing for this technology. Moreover, firms like Google are heavily investing in quantum technologies, with the introduction of its new quantum computing chip, Willow, in December 2023. These developments could play a crucial role in moving the industry forward even in the wake of recent downturns.

Recent Performance and Investor Sentiment

While IonQ’s share price faced challenges, analysts are still expressing optimism. Despite the shares trading as low as $49.06 last week, some experts raised their price targets. Benchmark and Needham & Company both increased their target evaluations, reflecting a belief that IonQ has substantial room for growth. Investors have also noticed that institutional interest has increased, with some large investors adding to their IonQ holdings in recent quarters, which shows that there is still confidence in the company’s underlying business, even if the stock market portrays a different picture.

Future Prospects for IonQ

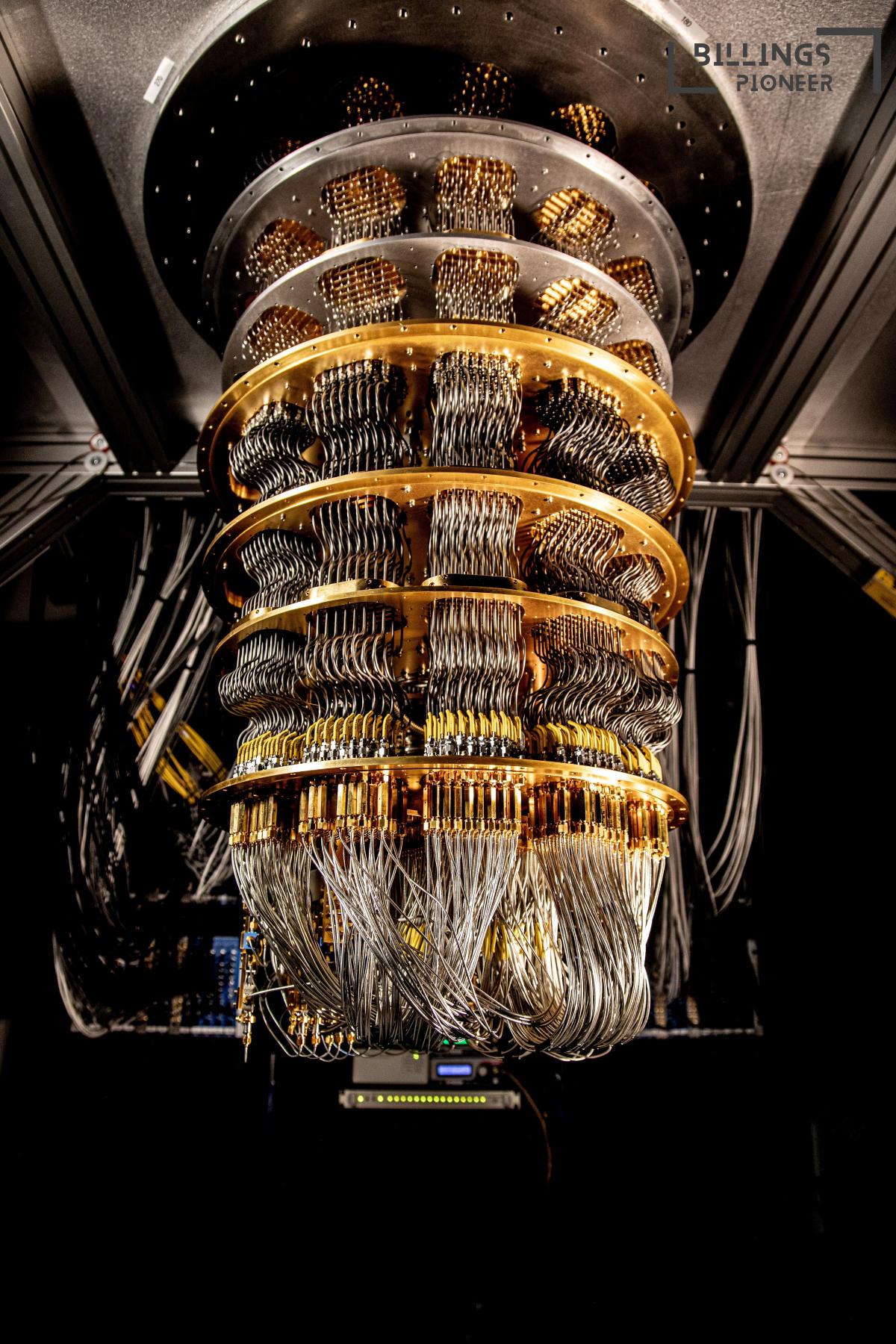

IonQ is not just sitting back; the company continues to innovate and expand its offerings. They develop general-purpose quantum computing systems and provide cloud-based access to these complex machines. Their revenue for the recent quarter reached $12.4 million, exceeding analyst expectations significantly. However, the company did miss earnings-per-share estimates, which contributed to investor anxiety. As IonQ navigates this turbulent landscape, it’s clear that how they respond in the coming months will be crucial for restoring investor confidence.

Conclusion

In summary, although IonQ and other quantum computing company stocks are experiencing turbulence right now, the broader developments in quantum technology and increased legislative support could foster recovery in the future. Investors will be watching closely to see how the situation develops in the face of Nvidia’s sobering predictions about the timeline of useful quantum computing.