In a fascinating twist of fate, Tesla stock has seen extraordinary growth over the past few years, making it a hot topic among investors. Recently, Elon Musk brought attention to a 2016 interview where legendary actor Morgan Freeman revealed he owned Tesla shares. This moment was significant because it highlights not just Freeman’s early insight, but also the incredible journey Tesla stock has taken since then.

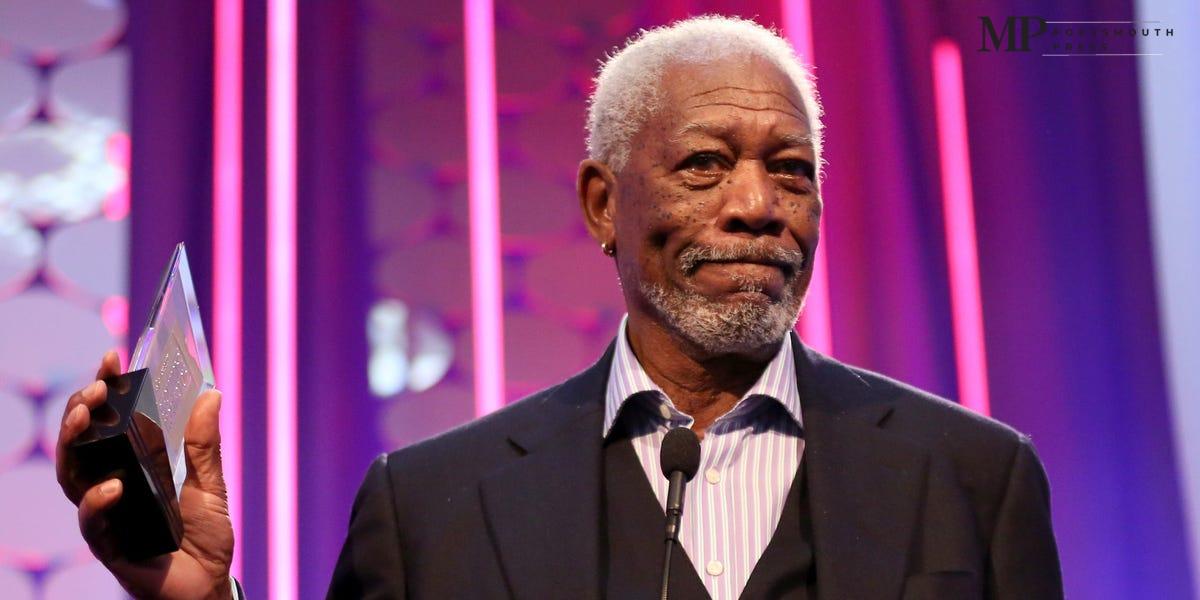

Freeman’s Bold Investment

Back in September 2016, Morgan Freeman mentioned owning Tesla stock in an interview on CNBC. At that time, Tesla shares were priced around $13.50, adjusted for splits. Fast forward to today, and Tesla’s stock is trading close to $415! If Freeman had invested $10,000 when he first talked about owning Tesla, that investment would now be worth around $307,000. That’s an amazing increase of about 3,000%. Imagine going from a small investment to having enough to buy a nice car or even contribute to a college fund!

Tesla’s Incredible Market Growth

Tesla isn’t just a success story for individual investors like Freeman; the company itself has seen astonishing growth. Since 2016, Tesla’s market capitalization exploded from about $30 billion to an unbelievable $1.3 trillion. That’s billion with a “B!” Their revenue climbed from $7 billion in 2016 to an impressive $97 billion in 2023. This data showcases how far Tesla has come and why many people are now eyeing the stock closely.

Current Market Performance

Now, as Tesla approaches its upcoming earnings report on January 29, 2025, investors are buzzing with excitement. Tesla’s stock price has doubled over the last year. Although, there are challenges ahead, such as slowing delivery numbers. In the past year, we’ve seen Tesla implement price cuts and explore multiple ambitious projects ranging from solar power to self-driving cars. As Tesla works on its groundbreaking technologies, the excitement continues, but so do the mixed feelings among investors.

What Do Analysts Say?

Analysts have different opinions on whether Tesla stock is a safe bet right now. Some are very optimistic, raising their price targets for the stock, while others advise caution. They are particularly concerned about the company’s declining profit margins and uncertain future projects. For instance, Tesla is set to launch a new Model Y SUV in March, and there’s buzz around its capabilities. Everyone is asking, “Is this the time to buy Tesla stock?”

The Future of Tesla Stock

Looking ahead, Tesla finds itself at a crossroads. While it has an impressive history of growth and innovation, the current market presents challenges. It’s essential for potential investors to research thoroughly and evaluate the company’s plans as they relate to future deliveries and earnings. This is especially true as Elon Musk pushes into new areas like artificial intelligence, which could either become major catalysts for growth or create uncertainties in the market.

Getting Involved with Tesla

Many young people today are looking to invest and learn about the stock market. If you’re interested in Tesla or any other stocks, start by asking questions and discussing with adults who have experience. You can also explore educational resources online to better understand how stocks work and why companies like Tesla have become so influential in today’s economy.