Reps. Katie Porter and Joe Courtney asked the Giles to respond by September 12 to a number of inquiries about MOHELA’s operations, such as whether the organization has enough personnel to support millions of student loan borrowers.

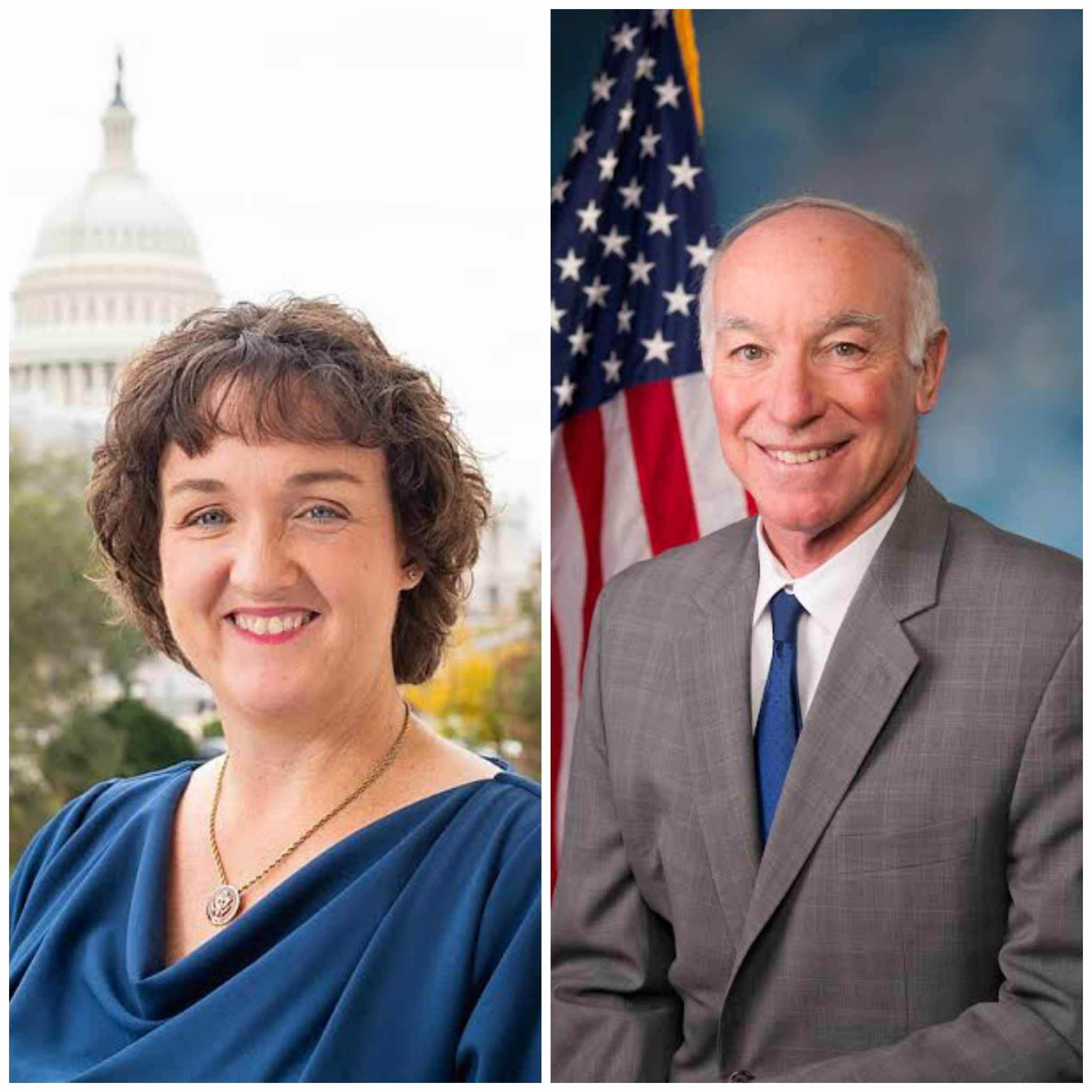

Katie Porter and Joe Courtney

A ‘history of mismanagement’ of a student-loan company is putting millions of student loan borrowers at risk.

Even though student loan repayment has not yet begun, millions of student loan borrowers are already encountering a number of issues. Two Democratic lawmakers, Porter and Courtney, are seeking clarification.

The Public Service Loan Forgiveness portfolio is managed by Scott Giles, the CEO of student loan provider MOHELA. On Tuesday, Reps. Katie Porter and Joe Courtney wrote to Giles addressing their concern about the financial problems millions of student loan borrowers may face.

President Joe Biden’s Education Department announced a number of changes to the PSLF, which is designed to cancel student debt for public sector and nonprofit employees after ten years of qualifying payments. The changes were made during the student loan payment pause, which is scheduled to conclude in September.

Since the Department decided to exclusively contract with MOHELA for PSLF in July 2022, servicing issues have been particularly common with this provider.

Many of these Millions of student loan borrowers complained that they had trouble getting their applications completed quickly or reaching a customer service agent who could address their inquiries about enrollment or repayment in the months after the Department’s decision.

Read Also: SAVE Student Loan Program Will Lower Payments For Many: Here’s What You Need To Know

Porter demands answers from MOHELA for having a faulty customer service and she wants to grant relief to millions of student loan borrowers in America.

Porter posted on her X (formerly known as Twitter) account, every American, even those who have already qualified for relief through the public service loan forgiveness program, is the target of my battle to provide student loan relief.

Millions of student loan borrowers ought to be informed about the implications of these new developments for their student loan debt, but federal loan servicers, such as MOHELA, have a track record of poor management that gives little reason for optimism.

Porter and Courtney asked the Giles to respond by September 12 to a number of inquiries about MOHELA’s operations, such as whether the organization has enough personnel to support millions of student loan borrowers, how long it typically takes for a borrower to contact customer service, and how MOHELA goes about incorporating changes the Education Department announces into its servicing procedures.

On September 1, 2023, student loan interest will once again accrue, and payments will again start to become due in October. At least three weeks prior to the due date, we will send you a billing statement.

Prior to the limited-time waiver’s expiration, some of these millions of student loan borrowers, as Insider has reported, had to wait hours on hold just to get a simple query about their repayment status resolved.

The issue affects millions of student loan borrowers, which hinders their ability to prosper financially and generally. We may strive toward achieving financial freedom for students by acknowledging the difficulties experienced by borrowers and putting in place comprehensive policies.

To effectively address this critical issue, regulatory changes, more financial literacy, better job market circumstances, and creative loan forgiveness schemes can all be very helpful. We can only lessen the hardships endured by millions of student loan borrowers and open the door to a brighter future by concerted efforts and collaboration.

Read Also: Following A $62 Million Hack, Curve Finance Announces A Refund Program.