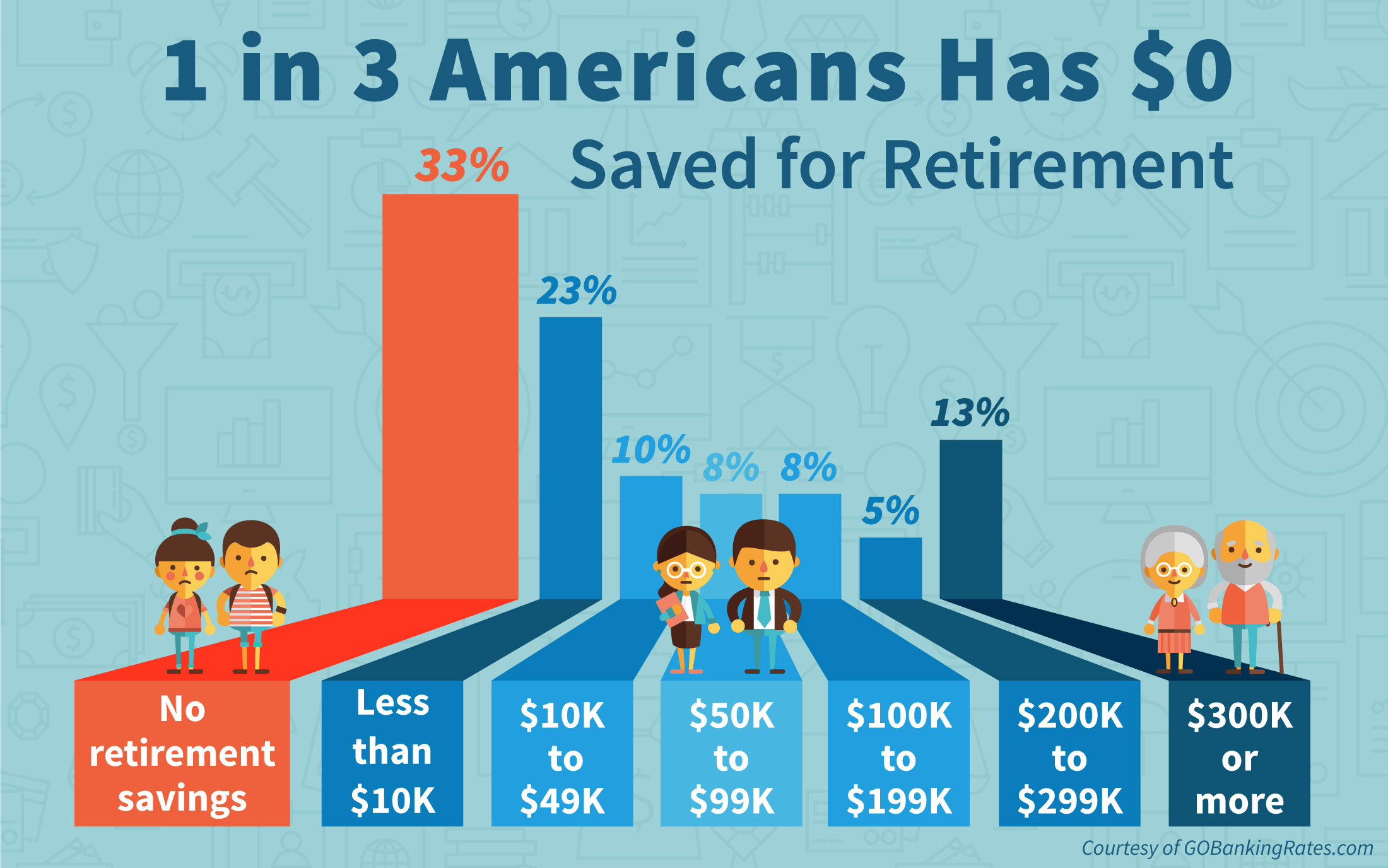

Millions of Americans are retiring with no savings

Report reveals about 90% of lower-income US workers retired without savings

Report reveals about 90% of lower-income US workers have nothing stashed away for retirement

In a recent article published by MoneyWise, many Americans are extending their time in the workforce and delaying retirement — especially when so many have no savings for their golden years at all.

Retirement without savings report, only one in ten low-income workers between the ages of 51 and 64 had a retirement account balance in 2019, compared to one in five in 2007, according to a July report from the Government Accountability Office (GAO). Rhode Island Senator Sheldon Whitehouse said that after a lifetime of work, all Americans should be able to retire with dignity. But today, millions of Americans go through a retirement without savings

The GAO points some of the factors as reason why millions of Americans go through retirement without savings. Some of these factors include longer job tenure, having a college degree, and larger employer contributions. About 23% of low-income workers have access to a workplace retirement account, while some opt out of making contributions and choose the retirement without savings especially if they suffer from limited income and rely on Social Security benefits.

Read Also:Millions of older workers are nearing retirement with nothing saved

Workers who choose retirement without savings usually rely on Social Security to cover their expenses and prepare for the trust fund to run low within the next decade. Setting yourself in retirement is already nerve-wracking, how much more if you don’t avoid retirement without savings.

To get ahead if you’re behind is to avoid retirement without savings. It always starts with the right retirement vehicle. For example, if your employer offers a 401k plan, you can divert some of your pre-tax pay into the account and grow your savings tax-free. Your employer might even match contributions as well. Again, this is to avoid retirement without savings.

Before you can save and avoid retirement without savings, make sure you’ve settled or have a plan for settling all your debts, this includes your credit cards and student loans. If you’ve started building your nest egg to avoid retirement without savings but think you’re behind on your goals or you aren’t sure of the best way to handle investing for retirement, it is best to speak with financial planner.

Read Also:Are you falling behind on your retirement savings? There are ways you can catch up — fast. Here are 5 strategies you can use