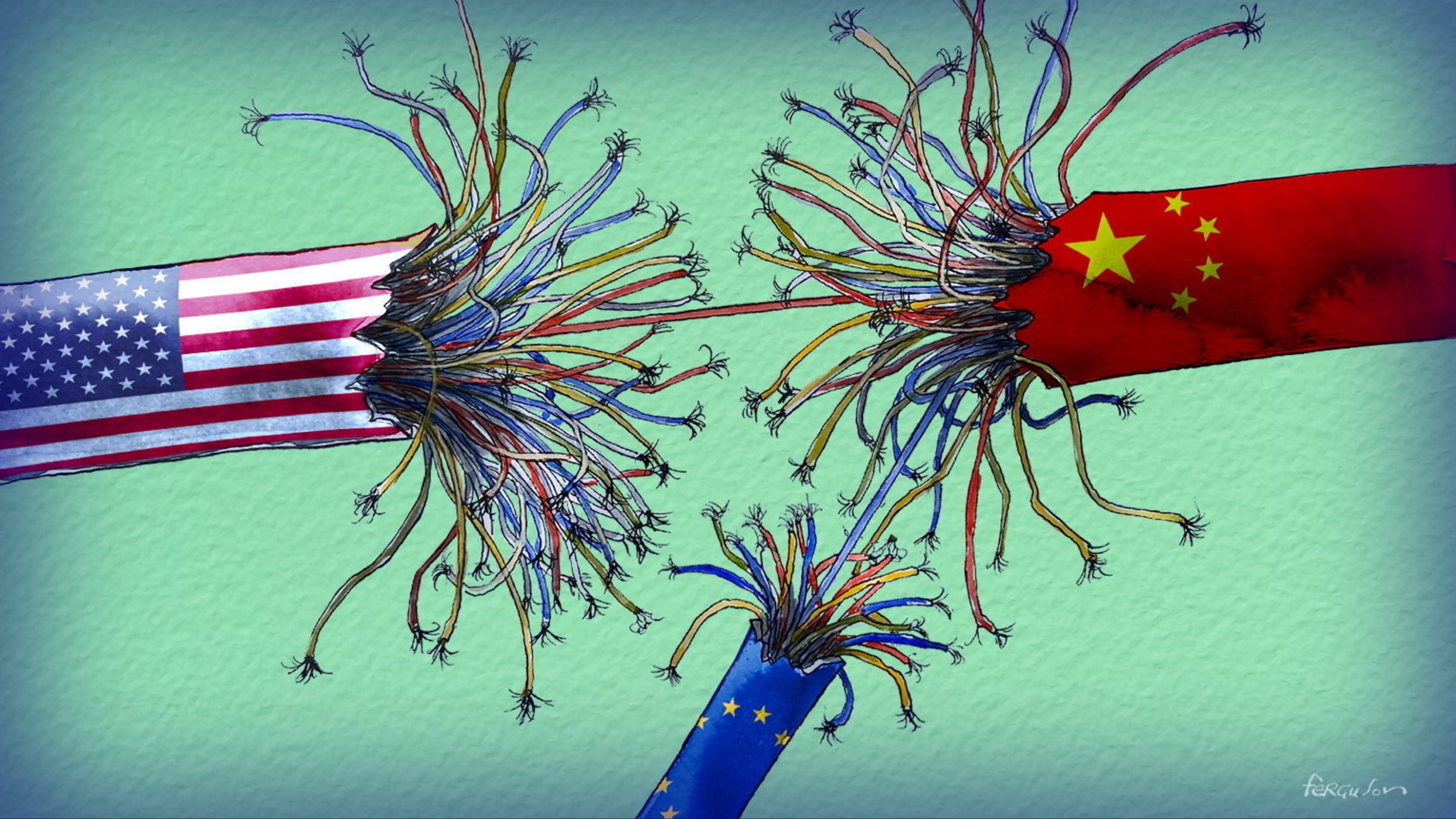

U.S. President Joe Biden’s top Asia diplomat, Kurt Campbell, implied in a recent interview that new restrictions limiting due to the de-risking strategy Chinese access to technology and investment were almost finished.

US and CHINA

An effort to be explicit about the distinction between a narrow de-risking strategy and a broad decoupling. The plan is to start diplomatic relations with China after this attempt.

De-risking strategy refers to the practice of financial institutions in which they end or limit business connections with certain clients or groups of clients in order to avoid risk rather than manage it.

As a result, there may be an increase in calls in Washington policy circles for tougher sanctions against China, which might lead to an unintended downward de-risking strategy cycle.

It is intriguing to think that de-risking strategy might eventually reach a point where China-related risks return to tolerable levels. Long-delayed policies limiting American involvement in Chinese technology firms were just presented by Biden’s team.

The criteria were developed after lengthy internal discussion and were rather specific, covering just a small number of topics, including artificial intelligence. There is ongoing proof of semiconductor de-risking strategy elsewhere.

Taiwanese semiconductor giant, TSMC announced in July that a new €10 billion plant would be built in Germany. In the event of a future battle over Taiwan, where the majority of cutting-edge semiconductors are made, the plan, which is a part of larger initiatives to spread out global production, aims to lessen the likelihood of shortages.

Read Also: EU Officials Are Taking A Fine-Tooth Comb To Biden’s Executive Order Against Investments In China

All of this reflects a variety of Western conundrums on how quickly and how far to cut ties with China. The fact that discussion of a complete decoupling has been dropped provides comfort to many.

De-risking strategy has gained widespread usage after being coined by European Commission President Ursula von der Leyen early this year. This seems to strike a reasonable medium position, averting the possibility of a disastrous total economic break with China.

From pharmaceutical supplies to electric vehicle batteries, de-risking strategy is intended to concentrate specifically on a limited number of important businesses. Usually, such policies are intended to lessen the risks associated with too relying on Chinese supply, which Beijing could use as leverage in a global conflict or even completely cut off in an emergency.

The most significant example is semiconductors, with TSMC as the chief manufacturer in mind. The chip giant is halfway through a globalization initiative that was sparked by pressure to diversify Taiwanese output. In addition to its plans for Germany, the corporation is investing $40 billion in new facilities in the United States and is also constructing others in Japan.

According to Boston Consulting Group, a fifth of TSMC’s cutting-edge chips will be produced outside of Taiwan by 2025, up from less than a tenth just a few years ago. Other businesses are taking similar moves. A new factory for Intel is also being planned in Germany. Another Taiwanese company, UMC, is stepping its production there. The change that results is substantial. By 2025, the United States, for instance, may own up to 16% of the world’s chip production capacity, up from 10% in 2018.

This all makes Western politicians happy. It suggests that de-risking strategy is effective in lowering reliance on Taiwanese-made chips and averting future conflict. Executives from Taiwanese semiconductor companies are less happy in private.

Building cutting-edge chips continues to be ideal in Taiwan. Massive, pricey facilities owned by TSMC are located on the island, where they are surrounded by an uncommon ecology of suppliers and laborers.

Due to a number of variables, the United States de-risking strategy towards China will definitely worsen. Strategic tensions, domestic political pressure, and economic competition between the two nations are a few of the major factors influencing this trend.

Read Also: Dangerous Cities In Wyoming: What You Need To Know