Improper Debt Assignment Notification is a violation to FDCPA

FDCPA Case Alleging Improper Debt Assignment Notification

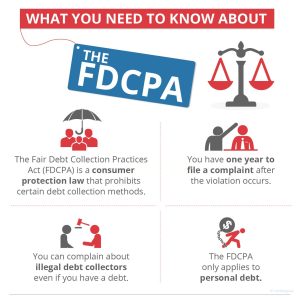

Debt collection agency should be aware of FDCPA

In a recent article published by JDSUPRA, the U.S. District Court for the Western District of New York granted the motion for alleged violations of the Fair Debt Collections Practices Act (FDCPA) relating to an allegedly improper debt assignment notification.

In McCrobie v. Palisades Acquisition XVI, LLC, the plaintiff incurred a credit card debt, which was later assigned to a new debt collection agency. In 2007, the new debt collection agency commenced an action to recover the debt and obtained a default judgment against the plaintiff. The plaintiff claimed that because the summons and complaint had been mailed to an old address, he had no knowledge of the action or the default judgment. The default judgment was later assigned to debt collection agency, Palisades Acquisition.

In 2014, an attorney from defendant Houslanger & Associates signed an income execution on behalf of debt collection agency Palisades Acquisition representing that it had the right to execute upon the judgment. Palisades Acquisition subsequently recovered $572.45 by executing on the plaintiff’s income.

Read Also:Fair Debt Collection Practices Act

The plaintiff contacted Houslanger & Associates and requested proof that debt collection agency Palisades Acquisition had the right to enforce the default judgment. Houslanger & Associates provided a copy of the bill of sale of the portfolio of the debt collection agency, which did not mention the plaintiff or the default judgment.

The plaintiff filed suit in 2015, asserting the debt collection agency Palisades Acquisition and its attorneys’ enforcement of the default judgment violated the FDCPA. The plaintiff argued that the debt collection agency Palisades Acquisition did not take the steps needed to enforce the judgment. Specifically, the plaintiff argued that for an assignment of a judgment to take effect, the assignor must notify the judgment debtor of the assignment. While an employee of the debt collection agency Palisades Acquisition testified that when it purchases a new debt portfolio, it will typically send an introductory letter to the debtors, the employee did not have the knowledge whether debt collection agency Palisades Acquisition’s predecessors in interest sent a notice of assignment to the plaintiff.

Both the magistrate and district judges found that the plaintiff had standing because the defendants allegedly deprived the plaintiff of more than $500 for several months by enforcing a default judgment in a manner that allegedly violated the FDCPA and state law.

Read Also:Enforcement of Information Blocking Penalties in Health Care IT Begins