The resumption of Wisconsin federal student loan repayments after a three-and-a-half-year hiatus in Winconsin.

The resumption of Wisconsin federal student loan repayments after a three and a half year pause. (Photo: Wisconsin Examiner)

Wisconsin Federal Student Loan Repayment Restart

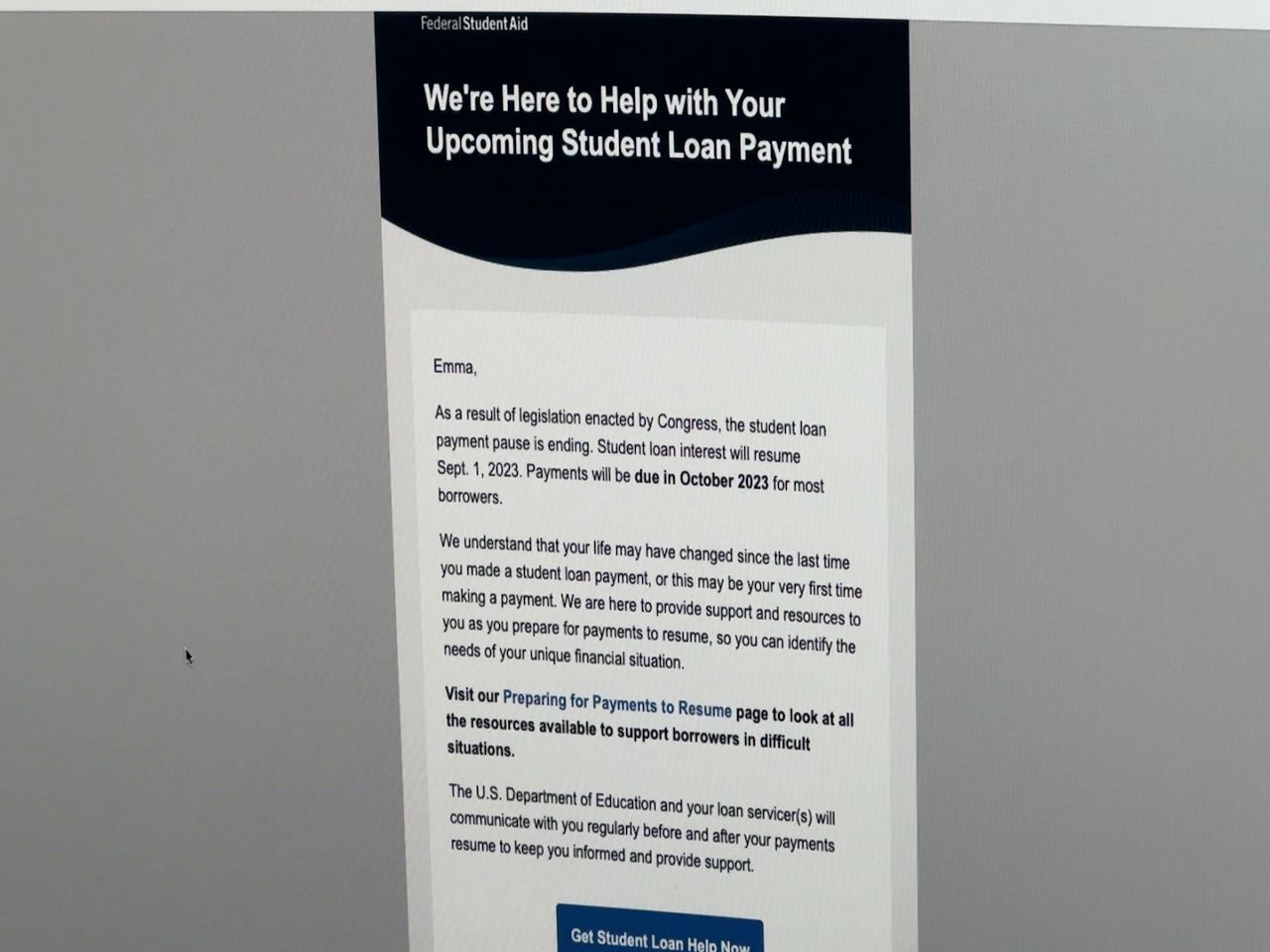

Wiscosin Public Radio – After a hiatus of three and a half years, federal student loan repayments are set to resume. Over 700,000 Wisconsinites with student loan debt will be required to restart their monthly payments beginning October 1, 2023. Wisconsin Public Radio’s “Morning Edition” host, Alex Crowe, discussed these developments with Benjamin Lee from the Wisconsin Coalition on Student Debt, shedding light on federal programs that can help borrowers manage their repayments and explore loan forgiveness options.

When Do Borrowers Need to Resume Payments?

Borrowers should expect to restart their payments in October. They will receive communication from both the Department of Education and their loan servicer regarding this transition. The Biden administration has introduced a one-year “on ramp” for student loans, providing a hold harmless period. During this year, borrowers are encouraged to make payments to make progress on their loans. Depending on their income and eligibility, some borrowers may have monthly payments as low as zero dollars under income-driven repayment plans.

Borrower Responsibilities

Borrowers are not necessarily required to proactively contact their loan servicer or the Department of Education. However, it’s crucial to ensure that their contact information is up-to-date on studentaid.gov, the primary Department of Education website for student loans. Additionally, they should know their loan servicer’s information, which can be found on studentaid.gov. With these basics in place, borrowers can explore repayment plans using tools like the loan simulator on studentaid.gov.

READ ALSO: Are You Afraid To Touch Your Individual Retirement Account? Here Is What You Need To Do.

White House Unveils Game-Changing Student Loan Repayment Plan and Eligibility Criteria

According to the article of Wasau Pilot and Review, one significant change is the introduction of a new income-driven repayment plan called SAVE (Saving on a Valuable Education). SAVE offers lower monthly payments compared to other income-driven plans and can even forgive interest not covered by the monthly payment, potentially reducing loan balances effectively to zero. For borrowers with low balances, loan forgiveness can be achieved in as little as 10 years of repayment. This borrower-friendly plan aims to alleviate the issue of runaway loan balances.

Eligibility for Income-Driven Repayment Plans

Eligibility for income-driven repayment plans is primarily based on the type of loans a borrower holds. Direct loans (excluding Parent Plus Loans) are eligible. However, they cannot be in default. Borrowers with FFEL loans or Perkins Loans can consolidate them into the direct loan program to access the SAVE plan. Consolidating these loans before the end of the calendar year can also provide additional benefits, including adjustments related to IDR and Public Service Loan Forgiveness.

Opportunities for Defaulted Loan Holders

For those with defaulted federal loans, there’s a unique opportunity to exit default. The Department of Education has introduced “Fresh Start,” allowing borrowers to remove themselves from default by taking simple steps. Once out of default, borrowers can access benefits like income-driven repayment plans, presenting a promising chance to regain financial stability.

READ ALSO: Optimizing Social Security Benefits For The Average Social Security Beneficiary: Why Age 62 May Not Be The Best Option